workers comp filing taxes

Free Consultation 702 384-1414. LI has a program to help.

Are Workers Compensation Benefits Taxable In Minnesota Best Law Firm For Workers Compensation Minnesota Personal Injury Lawyers Minneapolis St Paul Mn

Many businesses are facing financial strain due to the economy natural disasters pandemic or other serious problems.

. When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them. On the Tax and Workers Compensation Changes action choose the pay period begin date you want the changes to be effective on. This is one of the reasons why injured employees are only paid two-thirds of their pre-injury weekly wages.

Filing a claim for workers compensation benefits electronically in ECOMP. Standard Deduction Raised. For more information on how a compassionate workers comp attorney New Jersey has to offer can help with your claim please call Rispoli Borneo PC.

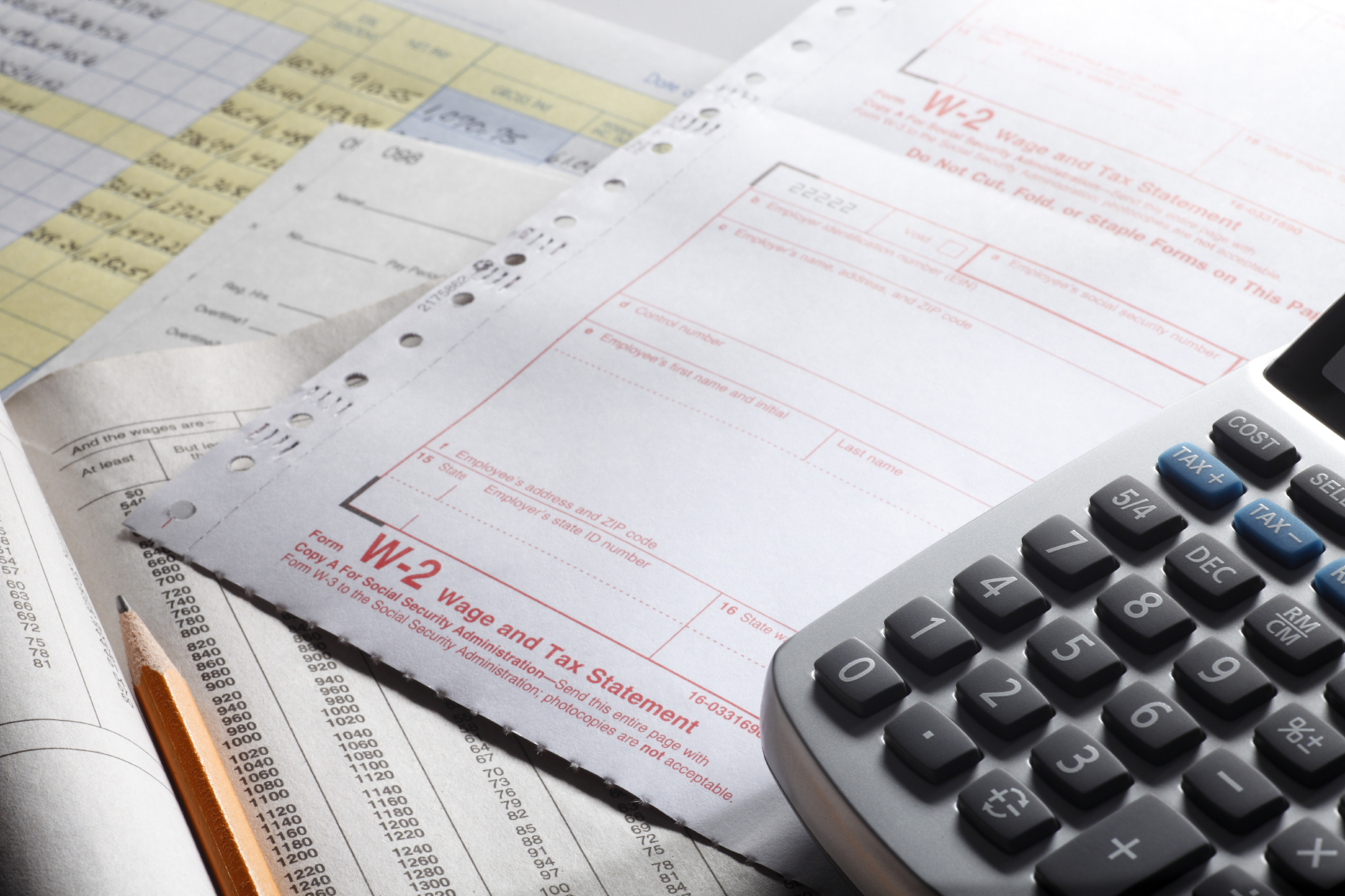

Our workers compensation services provide efficiencies by having premiums based on your actual payroll deducted automatically from each payroll cycle. Amounts received as workers compensation for an occupational sickness or injury are fully exempt from tax if paid under a workers compensation act or a. Compensation payments made via the Federal Employees Compensation Act FECA are generally not taxed.

Skip to content Call us for a. How to File Taxes on Workers Compensation Benefits. Its tax season and if you received workers comp benefits last year you may be wondering if that money is taxable.

File Quarterly Reports. Workers compensation benefits are not classified as taxable income. Workers compensation benefits and settlements are fully tax-exempt meaning you do not have to pay taxes.

Paper claim forms should be filed only if computer access is not available. Union Workers Comp Lawyers Help Workplace Accident Victims File Claims for Benefits With a population just over of 56000 Union Township is one of the most populous in the state of New. Bramnick Rodriguez Grabas Arnold Mangan LLC helps injured employees in New Jersey file NJ Workers Compensation claims for benefits.

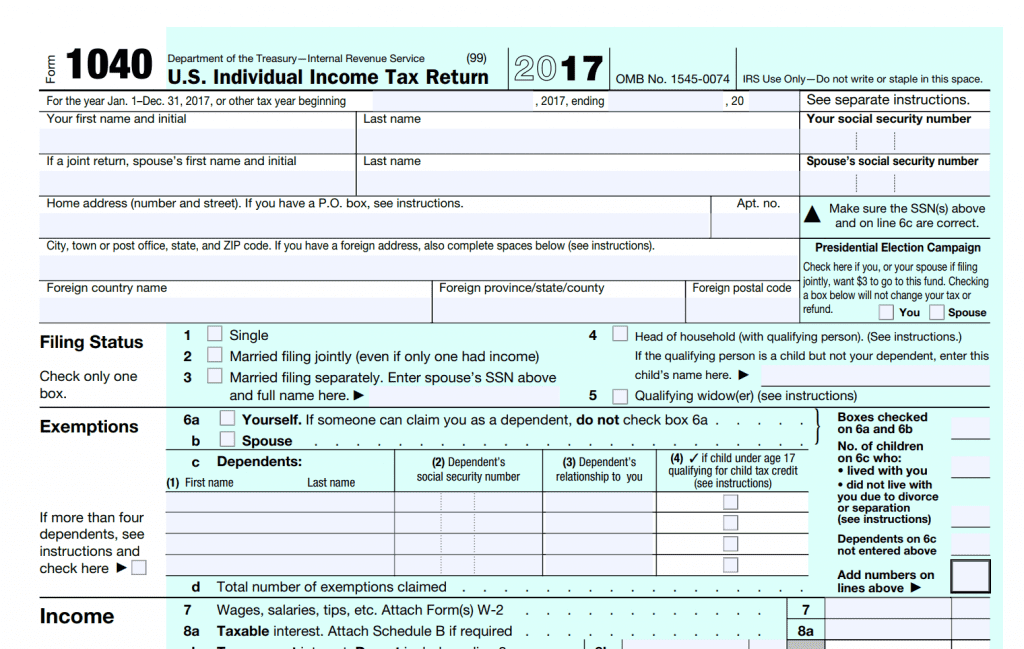

In most cases its not. According to the 2018 Publication 525 from the IRS amounts received from workers compensation for work-related. Is Workers Compensation Considered Income When Filing Taxes.

Revenue Procedure 2022-38 also stated that among tax deduction and exemption changes for 2023. If you received workers compensation benefits you likely dont need to include them anywhere on your taxes. IRS Publication 525 pg.

Although workers compensation is not taxable you are still required to file a return if the income you earned in addition to your workers compensation meets the IRS filing requirements. While workers compensation payments are considered income theyre not subject to an income tax and you dont need to report them on your IRS forms. However the payments that are made for up to 45 days while the.

The date that appears in this field will be the pay. The standard deduction for single taxpayers. The quick answer is that generally workers compensation benefits.

How Do Taxes Factor Into Workers Compensation

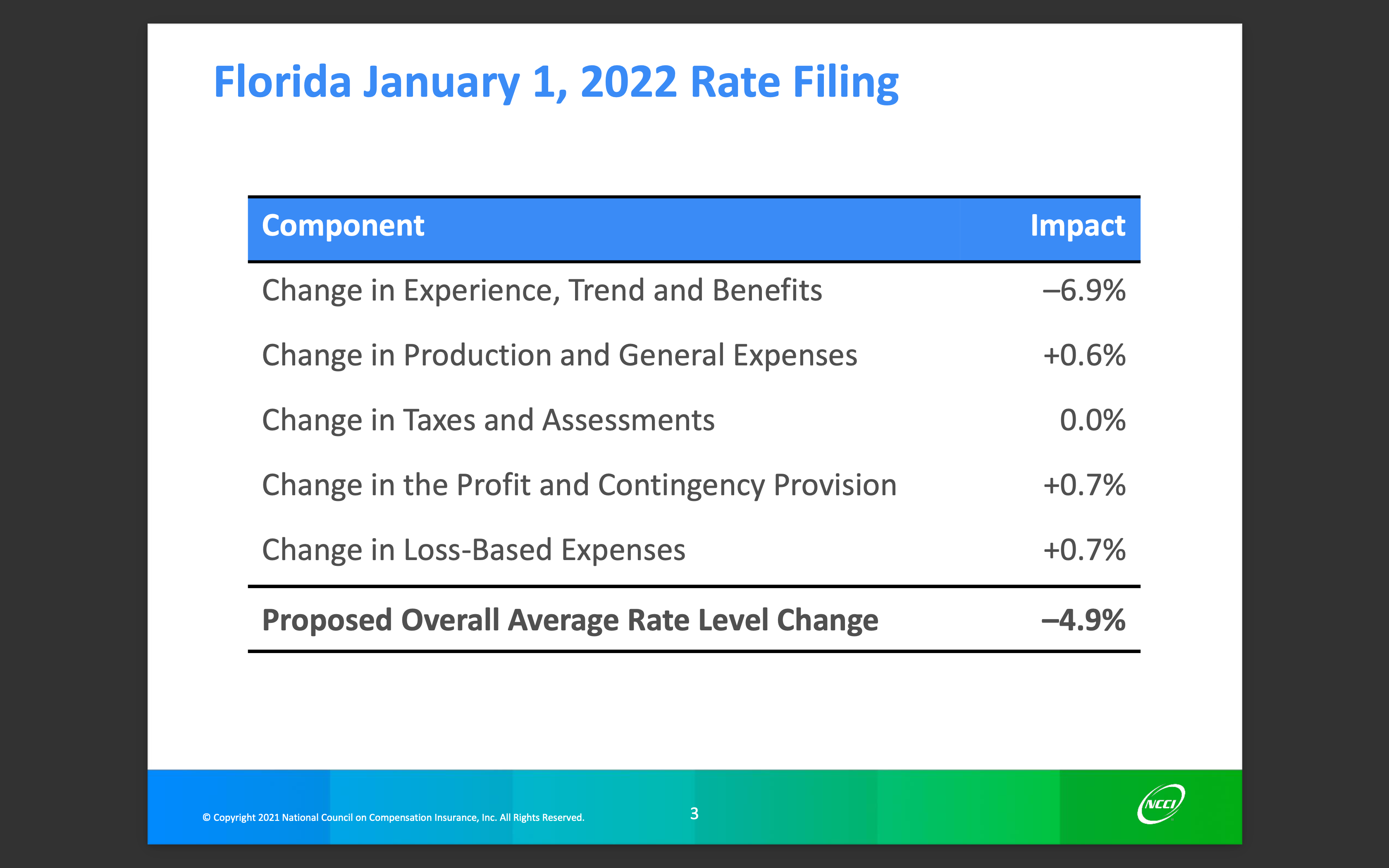

Florida Workers Comp Rates Set To Decrease Again

Do I Pay Taxes On My Workers Compensation Settlement In Ohio

Are Maintenance Payments Taxable Does Maintenance Count As Income The Young Firm

Do I Need To Claim Workman S Comp On My Tax Returns

Taxes Workers Compensation In Florida Touby Chait Sicking Pl

7 Tax Season Tips For Cleaning Businesses Insureon

The Earned Income Tax Credit And Community Economic Stability

Are Worker S Compensation Benefits Taxable In Georgia

Ohio Workers Compensation Benefits And Income Tax Monast Law Office

What To Do When You Re Offered A Workers Comp Settlement Top Legal Advice

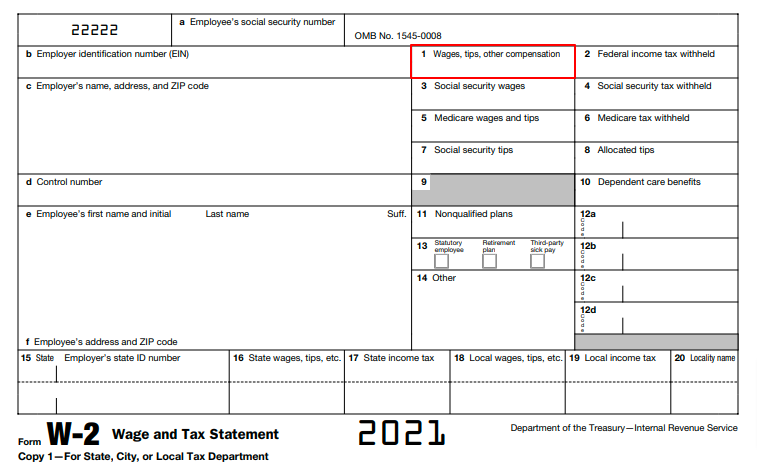

Your Guide To The W 2 Form Wage And Tax Statement Hourly Inc

Is Workers Compensation Taxable In Texas Thompson Law Call 24 7

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Get Workers Compensation Insurance For Your Small Business Gusto

Form W 2 Box 1 Guide For Navigating Through Confusing Discrepancies

Is Workers Comp Taxable Income In Michigan What You Need To Know